Save More Of Your Hard Earned Money With A Cash-Flowing, Tax-Saving Airbnb

(95% Done-For-You)

Get A Pre-Furnished, Cash-Flowing Airbnb In 45 Days And Save You $70,000-$240,000+ On Your Down Payment & Closing Costs.

Get A Pre-Furnished, Cash-Flowing Airbnb In 45 Days And Save You $70,000-$240,000+ On Your Down Payment & Closing Costs.

We find and show you existing, pre-furnished, cash-flow positive Airbnb properties, and you select the one you wish to buy.

We take care of 95% of the heavy lifting, guiding you through every step of the process to ensure a smooth and hassle-free experience.

We introduce you to a Co-Hosting company to get the property live in 1-3 weeks, a Cost Seg company to help with tax benefits, and a CPA to answer questions along the way.

We will help you buy a cash-flowing Airbnb and get tax benefits using our 10-3 Method™ …and the best part is, the whole process is 95% done-for-you.

The majority of first-time Airbnb owners sell their investment within 18 months.

Why?

Because of negative cash flow or sudden compliance issues.

Many of our clients come to us after they’ve already made these costly mistakes.

So, our team evaluates 2,500-4,000 deals every week just to find 3-10 that meet two critical criteria:

They must be cash-flow positive, based on historical performance and the seller’s terms.

And they must be compliant…

County-approved, HOA/POA-approved, and eligible for new permits or licenses.

If you miss just one of these steps, you could end up in a financial nightmare.

Short answer?

“If you roll the dice, be prepared to buy twice.”

You’re smart. You’re talented. You could do this on your own.

But… there are 81 potential failure points in every deal (our internal team checks every one).

Missing just a few could make your investment a disaster.

Real estate is unforgiving.

Every great investor has a team behind them.

Choose yours wisely.

We specialize in deals using Seller Financing.

These are sellers who own their homes outright.

They’re not in a rush for a huge payday.

And they want to avoid paying 22-35% in capital gains taxes.

So, they accept smaller upfront payments (lower down payments for you) in exchange for long-term monthly payments with interest.

This is how we secure:

It’s not rocket science. But it does take volume.

We analyze 450-900 deals for every 1 that works.

This is our niche. It’s all we do.

No one else does it like us, and we’ve been at it for years.

If another company says they do, ask them for five client case studies, five video testimonials, and five client introductions.

They’ll fall apart.

We won’t.

Our 5-figure program fee pays for itself the moment you save $70K-$240K on your first deal.

The majority of first-time Airbnb owners sell their investment within 18 months.

Why?

Because of negative cash flow or sudden compliance issues.

Many of our clients come to us after they’ve already made these costly mistakes.

So, our team evaluates 2,500-4,000 deals every week just to find 3-10 that meet two critical criteria:

They must be cash-flow positive, based on historical performance and the seller’s terms.

And they must be compliant…

County-approved, HOA/POA-approved, and eligible for new permits or licenses.

If you miss just one of these steps, you could end up in a financial nightmare.

Short answer?

“If you roll the dice, be prepared to buy twice.”

You’re smart. You’re talented. You could do this on your own.

But… there are 81 potential failure points in every deal (our internal team checks every one).

Missing just a few could make your investment a disaster.

Real estate is unforgiving.

Every great investor has a team behind them.

Choose yours wisely.

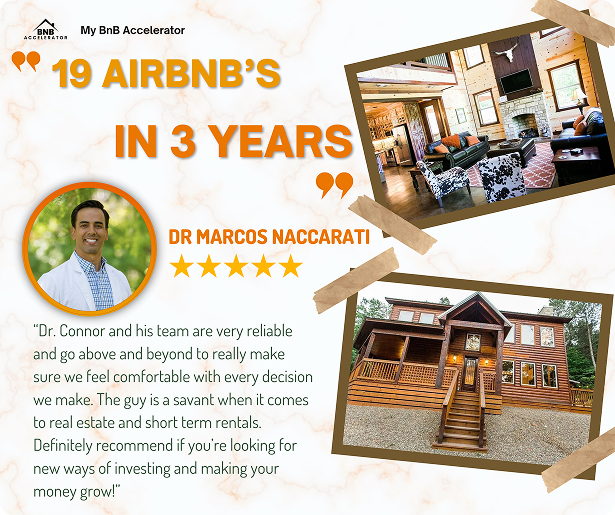

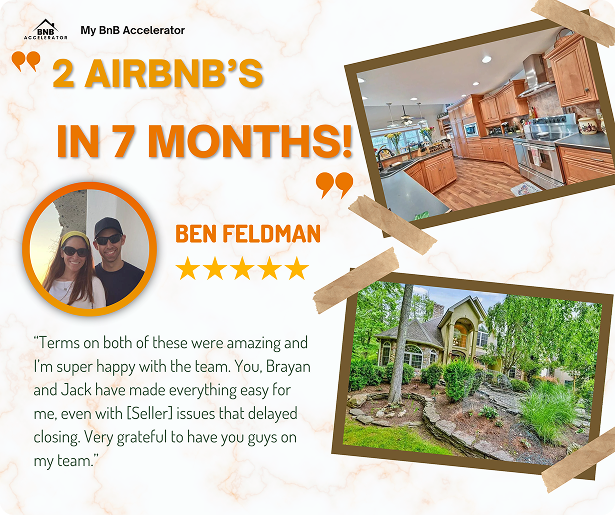

Check Out Some Wins From Our Clients

IMPORTANT: EARNINGS AND INCOME DISCLAIMER

All testimonials on this page are from real clients. The results you see on this page are not typical. Their experiences do not guarantee similar results. Individual results may vary based on your skills, experience, motivation, as well as other unforeseen factors. The Company has yet to perform studies of the results of its typical clients. Your results may vary.

TRUSTED BY 100s OF HIGH-INCOME EARNERS…

We offer much faster results and a higher likelihood of success.

Yes, but most first-time Airbnb owners make costly mistakes. There are (this is true) 81 “points of failure” in our internal checklists that can kill a deal, and missing or messing up on 2-3 of those can turn any investment into a nightmare. With our team, you’ll avoid these pitfalls and save both time and money.

Clients save between $70,000-$240,000 on average, thanks to our expertise in seller financing and negotiating deals.

No, since no new loan is required. Seller financing eliminates the need for traditional credit checks.

On average, 45 days from start to finish. Our team ensures a smooth, efficient transaction.

We connect you with a co-hosting company to manage the property, and a CPA to maximize your tax benefits.

Seller financing is a deal structure where the seller acts as the lender. This eliminates the need for a traditional bank loan, often leading to lower down payments and better terms.

We specialize in pre-furnished, cash-flowing Airbnb properties in high-demand areas.

Yes, we work with you to identify properties in locations that meet your goals and preferences.

No. While no investment is risk-free, we underwrite every property to ensure it has strong cash-flow potential based on past performance and market trends.

Airbnb investments can offer significant tax benefits, including depreciation and cost segregation studies that reduce your taxable income.

TRUSTED BY 100s OF HIGH-INCOME EARNERS…